Blockchain Beyond Bitcoin: Innovations in Finance and Investment

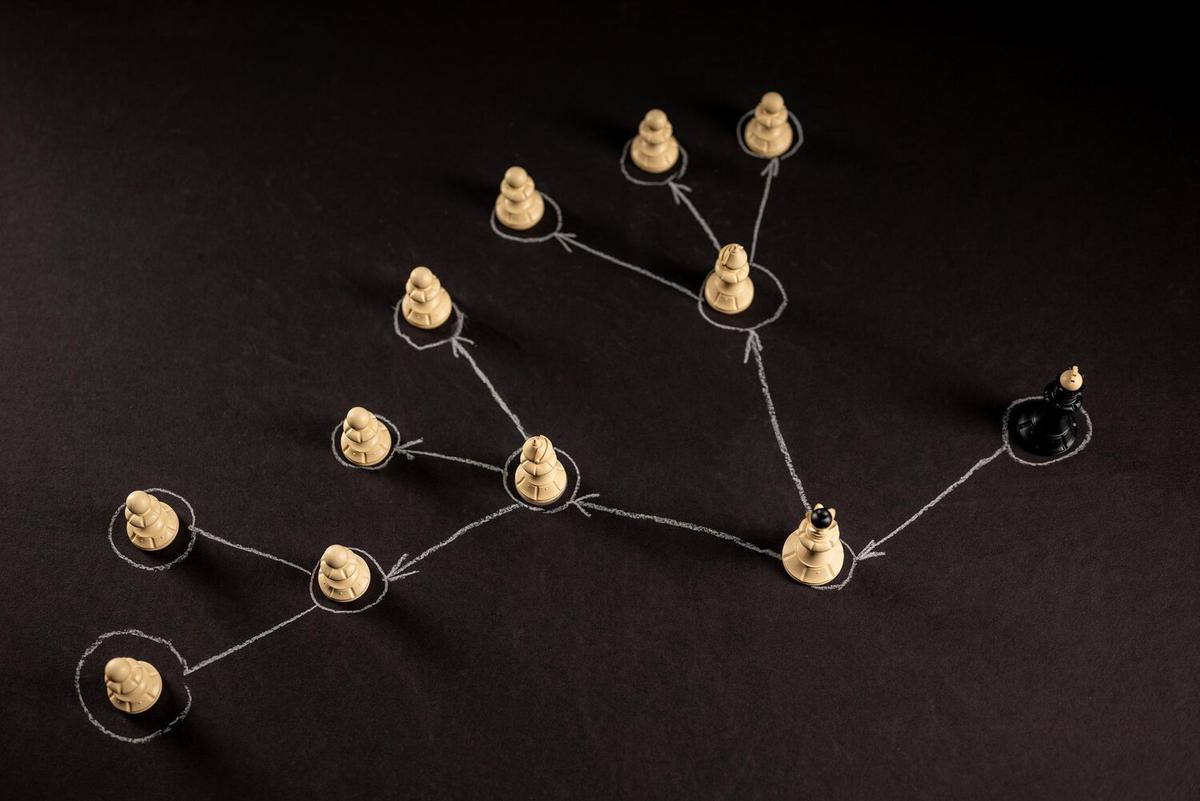

Blockchain technology has soared beyond the realms of cryptocurrency, carving a niche in finance and investment sectors that promises innovation and efficiency. While Bitcoin introduced many to the world of blockchain, its applications now extend far beyond digital currency.

An Evolving Landscape

The financial world is witnessing a significant transformation as blockchain technology reshapes traditional models. With its decentralized nature, blockchain offers transparency, security, and efficiency, making it an attractive option for various financial applications.

Expert Insights

According to Alex Tapscott, co-author of the book ‘Blockchain Revolution’, the potential of blockchain lies in its ability to establish trust among strangers. He notes, “Blockchain is the foundational technology behind the internet of value.” This sentiment is echoed by many financial experts who see blockchain’s potential to streamline complex financial processes.

Statistics and Trends

Research by Deloitte indicates that 53% of executives view blockchain as a critical priority in 2023, up from 43% in 2022. The adoption rate is a clear indicator of blockchain’s growing influence in finance.

Personal Anecdote: A New Trading Era

Consider Emma, an investment enthusiast, who recently turned to blockchain-based platforms for trading. She found the process more transparent and cost-effective compared to traditional platforms, highlighting the real-world benefits of blockchain in finance.

Actionable Tips for Investors

- Stay informed: Follow industry news and trends to understand blockchain’s impact on finance.

- Explore diverse platforms: Consider blockchain-based investment platforms for diversified portfolios.

- Understand risks: Blockchain technology is still evolving, so assess the risks before investing.

Invest in learning: Take online courses or attend workshops on blockchain technology to better understand its applications and potential in finance.

Blockchain Applications in Finance

| Application | Description |

|---|---|

| Smart Contracts | Automate contract execution without intermediaries. |

| Cross-Border Payments | Facilitate quick, low-cost international transactions. |

| Asset Tokenization | Convert physical assets into digital tokens for easier management. |

| Identity Verification | Secure, efficient identity management and verification processes. |

| Supply Chain Finance | Improve transparency and traceability in supply chains. |

| Decentralized Finance (DeFi) | Offer financial services without traditional banking systems. |

| Fraud Prevention | Enhance security measures to prevent financial fraud. |

| Peer-to-Peer Lending | Directly connect lenders and borrowers, reducing costs. |

Frequently Asked Questions

What is blockchain’s role in finance?

Blockchain streamlines financial processes by providing transparency, security, and efficiency.

How does blockchain improve investment opportunities?

Blockchain enables asset tokenization, smart contracts, and decentralized finance, offering new investment avenues.

Conclusion

In summary, blockchain technology is revolutionizing finance and investment sectors. With its ability to enhance transparency, reduce costs, and introduce innovative financial solutions, blockchain is poised to redefine the future of finance. As more industries embrace this technology, staying informed and adaptable will be key for investors and financial professionals alike.